CAPEX or OPEX: the difference, the rules, and a simple method for classifying your expenses (without making mistakes)

CAPEX or OPEX: the difference, the rules, and a simple method for classifying your expenses (without making mistakes)

You are faced with an expense (software, construction work, a study, new equipment) and the question arises at the end of the fiscal year or when the budget is being drawn up: CAPEX or OPEX?

Behind these two somewhat "corporate" acronyms lies more than just a simple accounting issue. There are also very concrete effects: on earnings, on EBITDA (earnings before interest, taxes, depreciation, and amortization), on team budgets, on investment decisions... and on how the company presents its performance.

The problem is that many organizations are looking for a "quick" rule: a computer = CAPEX, a subscription = OPEX, construction work = CAPEX...and end up piling up exceptions. But the right approach is different: it's not the nature of the expense that matters, it's the economics of the transaction (the real value to the company, its duration, and the benefits it provides).

The purpose of this article is to provide you with a robust, understandable, and actionable method—even for non-financial professionals—to avoid common mistakes and secure your arbitrage transactions.

CAPEX and OPEX: clear definitions (and what these words really mean)

OPEX: operating expenses ("current" expenses)

OPEX (Operating Expenditure) refers to expenses related to daily operations: salaries, energy, etc.

CAPEX: capital expenditure (fixed assets)

CAPEX (Capital Expenditure) refers to an expense that creates or enhances an asset intended to serve the company beyond the fiscal year: machinery, industrial tools, certain software, etc.

Confusion #1: Mixing up charges, disbursements, and amortization

A simple sentence can put things back in their proper place:

All expenses end up as charges... but the timing of the charge is key.

And this logic is independent of cash flow: you can make a payment today and record a charge over several years, or vice versa, record a charge immediately but make the payment later (accrued expenses, invoices not yet received, etc.).

The real criterion: the economics of the transaction (not the label "software," "works," "computer," etc.)

The useful reflex is to reason as follows: does the expenditure create a resource that:

- is controlled by the company (it can decide how it is used and capture most of the benefits),

- holds future economic benefits,

- and whose cost can be reliably measured?

If yes, it is closer to CAPEX (capital expenditure). If no, it is closer toOPEX (operating expenditure).

In other words: it's not "what it is," it's what it does, and for how long.

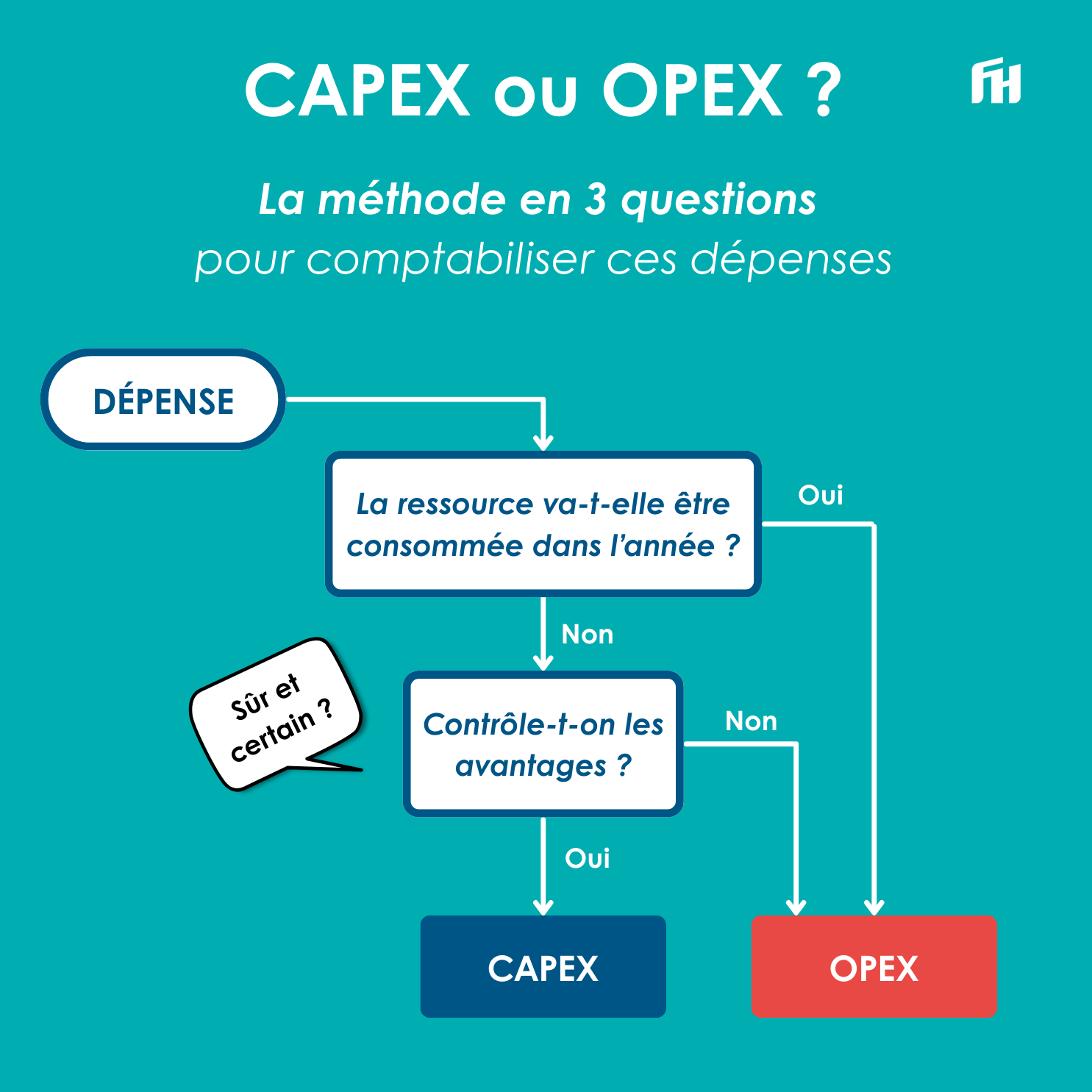

The simple method: the CAPEX/OPEX decision tree in 3 questions

You can apply this logic:

1) Will the resource be consumed within the year?

2) Is the resource being monitored?

3) "Certain and definite": are there identifiable future economic benefits?

This little tree has one merit: it forces discussion about facts (duration, control, benefits) rather than habits.

The most challenging (and most sought-after) cases

1) Software: CAPEX or OPEX?

The question is not "software"; the question is: what exactly are we buying?

A consistent analysis of the facts and circumstances is essential in order to decide on the accounting treatment, particularly for the following points:

- Perpetual license + commissioning + configuration

- SaaS subscription

2) R&D: when can we capitalize?

Under IFRS, the key distinction is research vs. development:

- Research: in charge (OPEX).

- Development: capitalizable only if a set of criteria is met.

3) Subsequent expenses: maintenance or improvement?

This is a classic example in industrial sites, fleets, real estate, and IT. Depending on the impact of maintenance, the expense will be classified as CAPEX or OPEX.

Why the CAPEX/OPEX classification changes everything: financial and managerial impacts

1) EBITDA / EBIT / net income: the "year 1 vs. subsequent years" effect

Depending on the CAEX/OPEX classification, financial indicators such as EBIT/EBITDA and net income are affected. Expenses may be recognized in full in a single fiscal year or spread out over time.

There are also impacts on other financial indicators such as ROCE, gearing, etc.

2) Governance: why CAPEX also "costs" in terms of processes

CAPEX commits the company for the long term: once the investment has been made, it is not easy to "divest." This leads to more demanding processes: business plans, profitability analyses, investment committees, etc.

To answer all your questions or to go further, FinHarmony has put together a short, practical case-oriented session: "CAPEX or OPEX? – The essentials in 3 hours", in a virtual classroom, to understand the rules, the impacts on results/budgets/cash flows, and to practice with real-life situations.

CAPEX/OPEX FAQ

What is the difference between CAPEX and OPEX?

OPEX = operating expenses recognized during the period.

CAPEX = investment recorded on the balance sheet and then depreciated over its useful life.

Is software CAPEX or OPEX?

It depends. The key is the economics of the transaction!

Why does EBITDA "improve" when capitalizing?

Because depreciation is below EBITDA.

IFRS 16: Is a lease CAPEX or OPEX?

Under IFRS, many leases create a right-of-use asset and a lease liability.

We often talk about "neither CAPEX nor OPEX" in the traditional sense.